Choosing the right credit cards to use can be as challenging as a game of chess—you can’t play passively against strong opponents—it takes some calculations, but with a strategy and knowing your spending habits, you can win the game.

Credit cards can be an incredibly powerful tool to earn rewards and cash back on spending you already do. Using the best credit cards in Canada, you can save money through generous insurance coverage included with your card or use rewards to offset the cost of your trip.

Insurance

Some of the best travel credit cards in Canada offer incredibly generous insurance coverage at no additional cost. For example, the Scotiabank Gold American Express card comes with travel accident and emergency medical insurance. You’re also covered with a spending allowance in the event that your flight or baggage is delayed or lost. Trip cancelled or got into an accident with your rental car? Covered. For those that travel often, these cards can save you time and money when things go wrong, all at no additional cost.

Sign-ups and promotions

Many credit cards come with spending bonuses, signup bonuses or one-time offers that are worth taking advantage of. For example, one of the best cash-back credit cards in Canada right now is the SimplyCash Card from American Express, which is currently offering 5% cash back on gas, groceries, and restaurants for the for first six months (up to $250). There are always many different offers to take advantage of, so make sure to do your research.

Rewards programs and categories

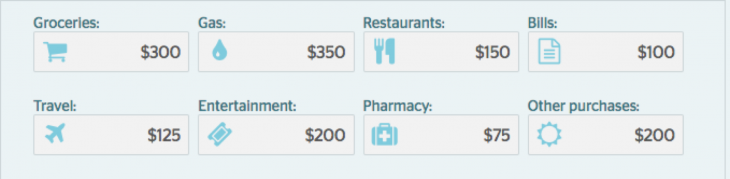

While taking advantage of one-time offers and spending bonuses is great, ideally the credit card you have should benefit you beyond the first six months of ownership. This is where rewards programs and categories come into play. It’s important to understand where you are spending your money so that you can choose a credit card that will maximize your rewards. For example, with the Scotiabank Gold American Express card, using the following spending profile and factoring in sign up and spending bonuses, you would earn $915 in travel rewards in the first year and $441 in the second year. If you’re looking for a great no-fee card, the Tangerine Money Back MasterCard is a good choice, netting you $268 in the first year and $243 in the second year.

Depending on your spending profile, the card you choose and the rewards you earn will vary, which is why it’s critical that you understand your spending, do your research, and choose the credit card that best fits your spending profile.

Happy travels!

Now, here’s your chance to win a $250(CDN) Pre-Paid Credit Card care of RateHub.ca and TheSceneinTO! Take our short quiz below and don’t forget to leave your email address at the end of the survey. Your name and email address will never be shared by TheSceneinTO.com or RateHub.ca with any 3rd Party. It is used solely to contact the winner. The answers to the quiz are anonymous.

Contest closes July 31, 2017.

Leave a Reply